-

Base Compensation and Regular Rate of Pay

Base compensation and regular rate of pay are important concepts related to the Fair Labor Standards Act. The solution can be configured to calculate and provide you with an employee's base compensation and regular rate of pay.

1:55

-

EEO-1 Overview

EEO-1 Overview

2:32

-

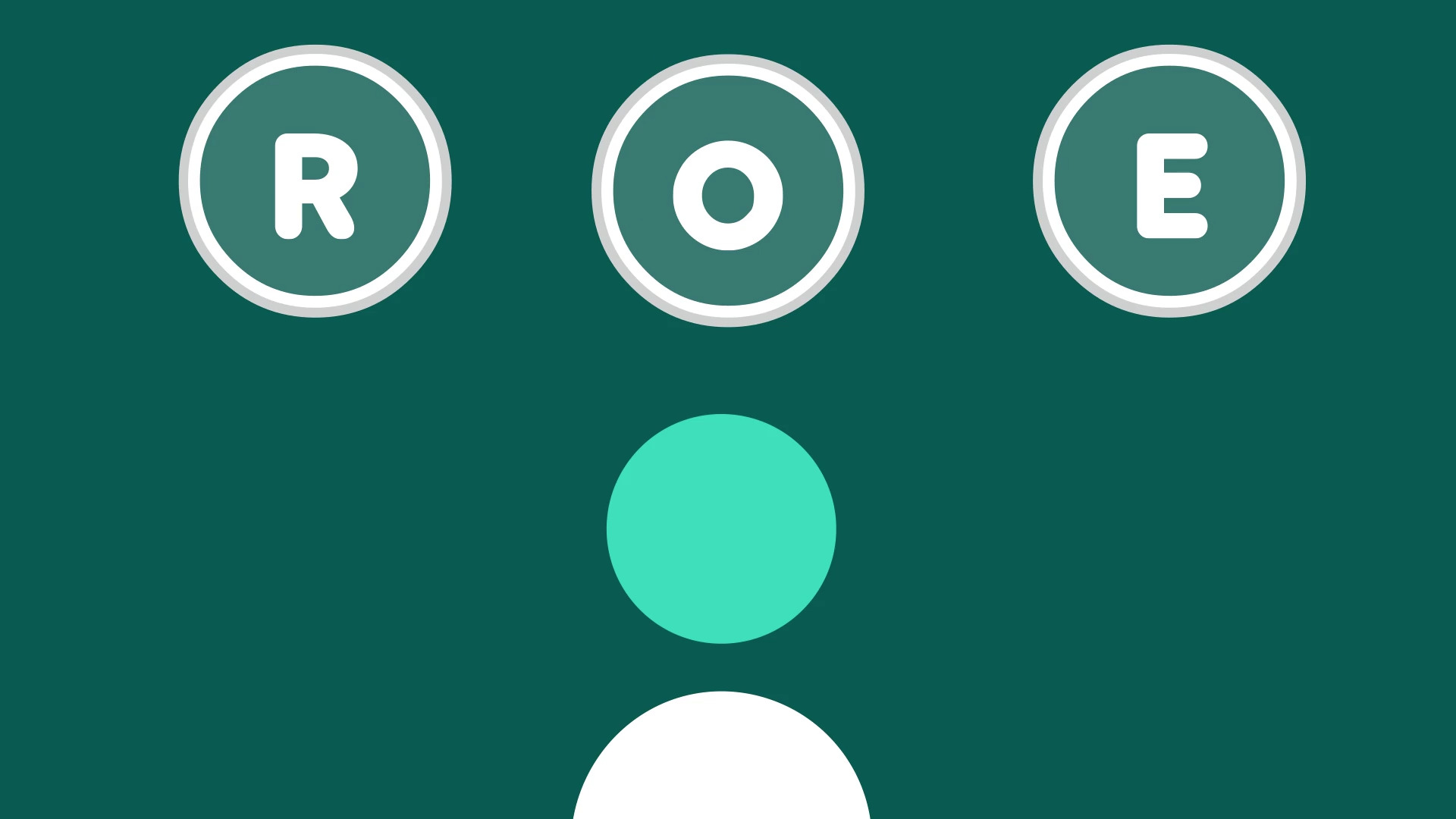

Employment Eligibility Verification

Reviews I9 and E-Verify concepts

1:43

-

Employment Status

Employers use employment statuses to track who is currently employed and eligible for compensation, benefits, and other perks.

2:06

-

Fair Labor Standards Act (FLSA) Overview

The Fair Labor Standards Act, FLSA, is a federal law that establishes minimum wage and overtime pay requirements for covered employees.

1:54

-

Form W-2

Form W-2 is a document used in the United States to report an employee's annual wages, benefits, and the taxes that have been withheld from their pay throughout the year.

2:27

-

Jobs

A job can have defined attributes or describe a specific role.

1:02

-

Jobs versus Positions

A job refers to a particular role held by an employee, outlining their responsibilities and duties. Positions inherit job characteristics and enable your organization more attributes.

1:42

-

Occupational Safety and Health Administration (OSHA) Overview

The Occupational Safety and Health Administration is a federal agency in the United States Department of Labor that is responsible for ensuring safe and healthy working conditions for employees.

2:41

-

Pay Types

Pay structures such as hourly or salary pay can have important implications for employee compensation, job satisfaction, and overall workplace dynamics.

2:13

-

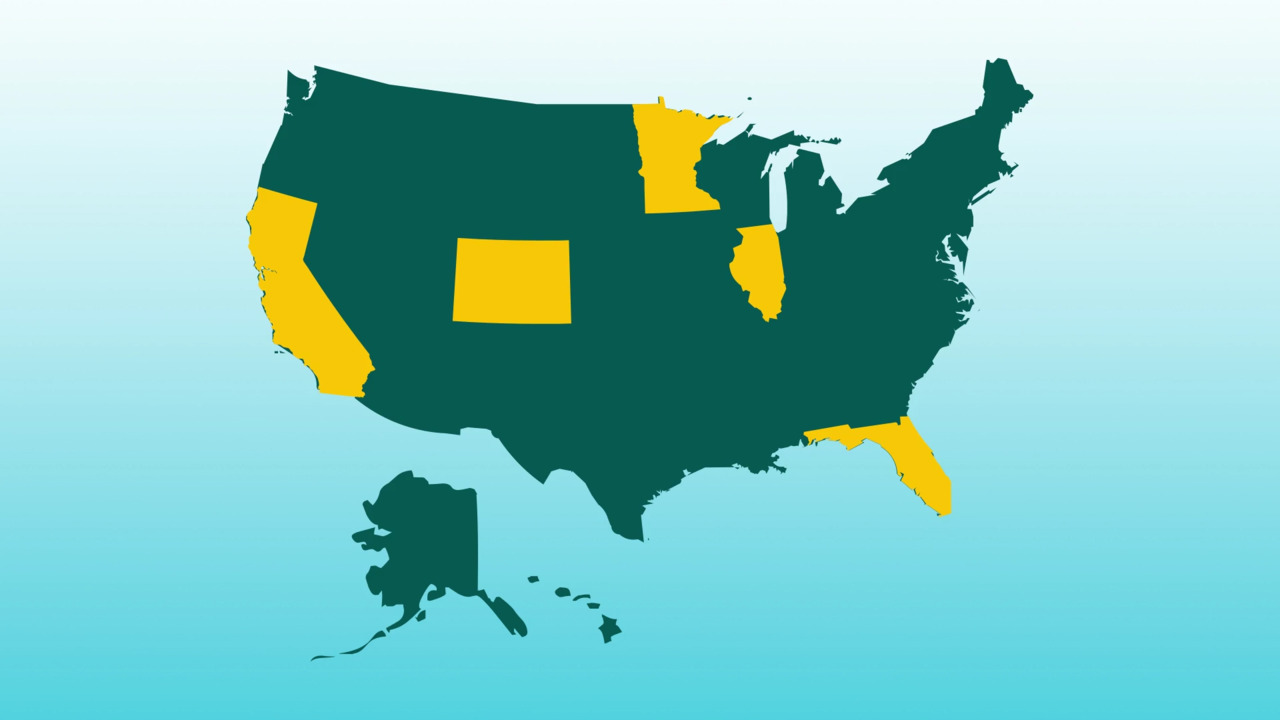

Record of Employment (ROE)

The Record of Employment (ROE) is the form employers process for employees receiving insurable earnings who stop working and experience an interruption of earnings.

3:17

-

Salary Grades and Pay Scales

Salary grades and pay scales are both methods used to establish compensation rules for employees, but they differ in their approach

2:09

- Load More

UKG Concepts Video Gallery